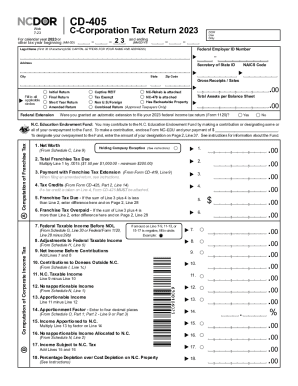

NC DoR CD-405 2024-2025 free printable template

Get, Create, Make and Sign cd 405 form

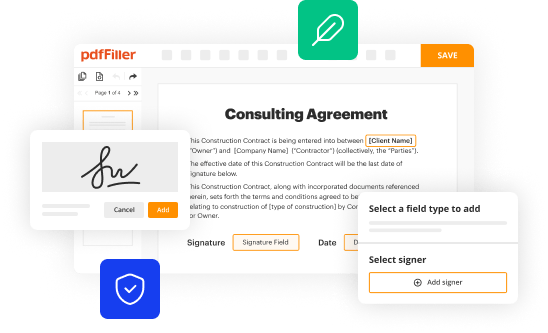

Editing cd 405 online online

NC DoR CD-405 Form Versions

How to fill out nc cd 405 instructions form

How to fill out NC DoR CD-405

Who needs NC DoR CD-405?

Video instructions and help with filling out and completing nc form cd 405 instructions

Instructions and Help about cd 405

Laws dot-com legal forms guide form CD 405 C corporation tax return C corporations operating in the state of North Carolina use a form CD 405 to file their state taxes owed this document can be found on the website of the Department of Revenue of the state of North Carolina step one and to the fiscal year dates for which you are filing if not filing on a calendar year basis your corporations name address and tax identification number gross receipts and sales total assets per balance sheet and fill in the ovals next to all applicable statements concerning your return attached forms and relationship to another corporation step 2 compute your franchise tax owed in Section a step 3 computer corporate income tax owed in Section B as well as any refunds you may be owed step 4 document your capital stocks surplus and undivided profits in Section C step 5 document investments in North Carolina tangible property in Section D, and it's appraised value in section e step 6 sections F requires you to answer miscellaneous questions step seven sections G and H concern your federal taxable income step eight section I concerns donations made step nine sections J is only for those who are filing an amended return to explain all changes step 10 documents your balance sheet per books in Section L step 11 document non-apportionable income in Section M step 12 compute your apportionment factor in section o step 13 an officer should sign and date the bottom of the second page additionally include your corporate telephone number step 14 if a paid preparer has completed this form they should sign this form and provide an identification number mail the completed return to the address given to watch more videos please make sure to visit laws dot-com

People Also Ask about cd tax

What is the North Carolina tax form called?

What is a NC 40 form?

What is a NC 5 form?

Who is exempt from N.C. withholding?

What is a d400 form for North Carolina?

What is NC-4 form for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the cd tax electronically in Chrome?

Can I edit how to nc corporation tax return on an Android device?

How do I complete nc form cd 405 on an Android device?

What is NC DoR CD-405?

Who is required to file NC DoR CD-405?

How to fill out NC DoR CD-405?

What is the purpose of NC DoR CD-405?

What information must be reported on NC DoR CD-405?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.